Achieving financial stability and long-term security requires saving money, which is a basic component of personal finance. Having sound saving techniques in place is crucial, regardless of your goals—building an emergency fund, saving for a significant purchase, or making retirement plans. To assist you in attaining your financial objectives and optimizing your savings potential, we will examine a variety of saving strategies, tactics, and advice in this extensive book.

Before delving into specific saving strategies, it's important to understand why saving is essential for financial well-being:

Financial Security: By lowering the need for debt or other forms of finance, saving offers a safety net to cover unforeseen costs, emergencies, or times of financial hardship.

Goal Achievement: By building up the required cash over time, saving enables you to work toward certain financial objectives, including buying a home, paying for college, or taking trips.

Building Wealth: By allowing your money to increase through compound interest over time, saving and investing can help you achieve long-term financial freedom.

Flexibility and Freedom: Having funds frees you from financial commitments or restrictions, allowing you to seek opportunities and make decisions.

Key Strategies for Saving:

Let's now examine a number of sensible saving techniques that you can use to increase your financial stability and accomplish your financial goals:

1. Create a budget:

Your financial plan is built upon a budget, which enables you to prioritize spending, keep track of income and costs, and spot areas where savings may be made. To construct a budget, take these actions:

- Track Your Expenses: To get a better understanding of where your money is going, keep an eye on your spending patterns for a month.

- Create Spending Categories: Divide your costs into categories that are necessary (such as housing, utilities, and groceries) and optional (like eating out and entertainment).

- Establish Savings Objectives: Set aside a percentage of your income for long-term investments, debt repayment, and emergency fund contributions.

- Check and modify: To make sure your budget is in line with your financial priorities and goals, check it frequently and make any necessary revisions.

"Pay yourself first" is a well-liked savings technique that entails setting aside money for savings before you pay other bills. Here's how to successfully put this strategy into practice:

Set Up Automatic Transfers: Decide whether parts of your salary should be deposited automatically each pay cycle into an investing or savings account.

Start Small and Build Up Over Time: As your income rises or your costs fall, start saving a smaller portion of your income and progressively raise it.

Save for Savings as a Non-Negotiable Expense: Give savings contributions the same priority as other financial commitments, such as bill payments.

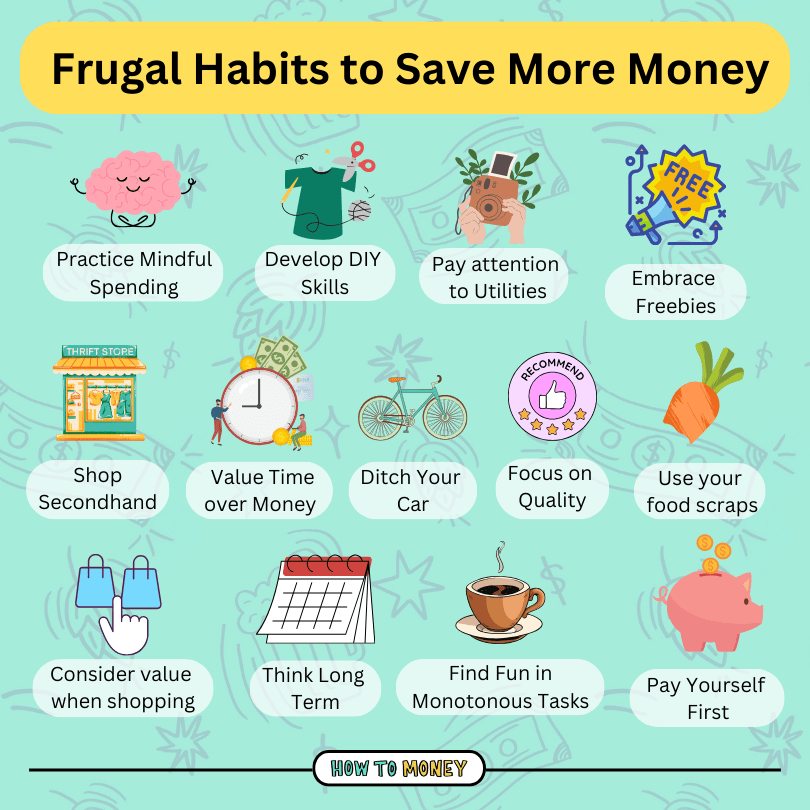

3. Develop frugal living habits.

Living frugally entails making deliberate decisions to cut costs, live within your means, and give value precedence over consumption. The following is some money-saving advice for a frugal lifestyle:

Monitor Your Expenses: Maintain a log of your expenditures and pinpoint any areas where you can make savings or curtail discretionary spending.

Shop Wisely: To optimize savings on purchases, compare prices, use coupons, buy in bulk, and take advantage of deals and discounts.

Cook at Home: Making meals at home can save costs and offer more economical, healthier options than going out to eat frequently.

Embrace Minimalism: Prioritize relationships and experiences over material belongings when you declutter your home and lead a minimalist lifestyle.

4. Create an emergency fund.

By covering unforeseen costs or income disruptions without turning to high-interest debt, an emergency fund offers financial security and peace of mind. Observe these actions to create an emergency fund:

Establish Savings Goal: To ensure a solid safety net, try to save three to six months' worth of living expenses in your emergency fund.

Select the Appropriate Account: Keep your emergency money in a money market account or high-yield savings account with competitive interest rates and convenient access.

Automate Contributions: To guarantee recurring contributions over time, plan automated withdrawals from your checking account or paycheck into your emergency fund.

Avoid temptation: Save your emergency fund for true crises by resisting the need to use it for non-essential expenses.

Embrace Minimalism: Prioritize relationships and experiences over material belongings when you declutter your home and lead a minimalist lifestyle.

5. Reduce Debt:

Achieving financial freedom and freeing up funds for investing and saving requires paying off debt. Use these techniques to cut down on and get rid of debt:

Prioritize High-Interest Debt: In order to reduce interest expenses, concentrate on paying off high-interest debt first, such as credit card balances or payday loans.

Debt Avalanche or Snowball technique: Decide whether a debt repayment plan, which involves paying off debts with the highest interest rates first, is more effective for you. The debt snowball technique involves paying off debts in the order that they are largest to smallest.

Negotiate Lower Interest Rates: To reduce monthly payments and interest expenses, get in touch with creditors to negotiate lower interest rates, consolidate debt, or look into refinancing options.

6. Establish particular savings goals.

SMART (specific, measurable, realistic, relevant, and time-bound) savings goals provide you with the focus and drive to stick to your plan. This is how to create SMART savings objectives:

Be Particular: Whether you're saving for a down payment on a house, an emergency fund, or a trip, be sure to clearly outline your savings objectives.

Establish Measurable Goals: Figure out how much you need to save and mark your progress with milestones and checkpoints.

Set realistic savings objectives that you can achieve within your time and money constraints.

Relevance and Time-Bound: Make sure your savings objectives give you a feeling of urgency and purpose by matching them with your priorities, values, and timeframe.

7. Make the Most of Your Savings Chances:

Utilize a range of chances and rewards to optimize your ability to save and quicken the process of reaching your financial objectives:

Employer-Sponsored Retirement Plans: To increase your retirement savings, make contributions to employer-sponsored retirement plans, such as 403(b)s or 401(k)s, and take advantage of employer matching contributions.

Health Savings Accounts (HSAs): If your health insurance plan has a high deductible, you can save tax-advantaged money for qualified medical expenses by contributing to an HSA.

Individual Retirement Accounts (IRAs): To enhance employer-sponsored retirement savings and take advantage of tax benefits on investment gains, make contributions to either regular or Roth IRAs.

Open a 529 college savings plan to take advantage of tax-deferred growth and possible state tax benefits while saving for educational costs like tuition, fees, and books.

In summary, saving money is an essential component of personal finance and a necessary first step in obtaining long-term wealth and financial security. You can create a strong financial foundation and work toward reaching your financial goals by putting into practice efficient saving techniques like budgeting, paying yourself first, taking up frugal living habits, creating an emergency fund, paying off debt, setting specific savings goals, and taking advantage of savings opportunities. Recall that while saving is an ongoing activity requiring dedication, discipline, and persistence, the benefits of financial independence

Comments

Post a Comment